FOLLOWING THE IMPLEMENTATION OF GST IN THE COUNTRY, MANY OF THE NON REGISTERED VENDORS, IN THIS CASE, THE RESTAURANTS, HAVE STARTED TAKING ADVANTAGE OF THE SITUATION, AND BEGAN FLEECING THEIR CUSTOMERS IN THE NAME OF GST. MOST OF THE RESTAURANTS CHARGES 18% GST ON THE FOOD ITEMS BUT DO YOU KNOW IF THEY ARE REGISTERED OR ELIGIBLE TO CHARGE 18%?? CHECK THIS SENSATIONAL REPORT OUT…

If you have been to the restaurants lately, you might have surely observed the taxing structure of them, which quite looks weird, as many of them charge 9 + 9 percent totaling to the 18% on the food bills. In front of first 9%, you can see SGST and CGST but have you also observed another GST of 18% besides the above two anytime? If yes then it is the time to take some action against such malpractices.

According to the reports, there are many non-registered restaurants that are duping their customers under the name of GST. The GST law clearly specifies that the vendors that are not registered under the GST should not collect the same from the customers on sales, and cannot claim the same as credits on the good that have purchased by them from the markets.

The non-registered vendors have to issue the normal invoices which should not include any kind of taxes, or it can be inclusive of GST. But, despite this fact, there are complaints of the restaurants charging the GST to their customers in an unauthorized manner and thus robbing them of extra money in the broad daylight.

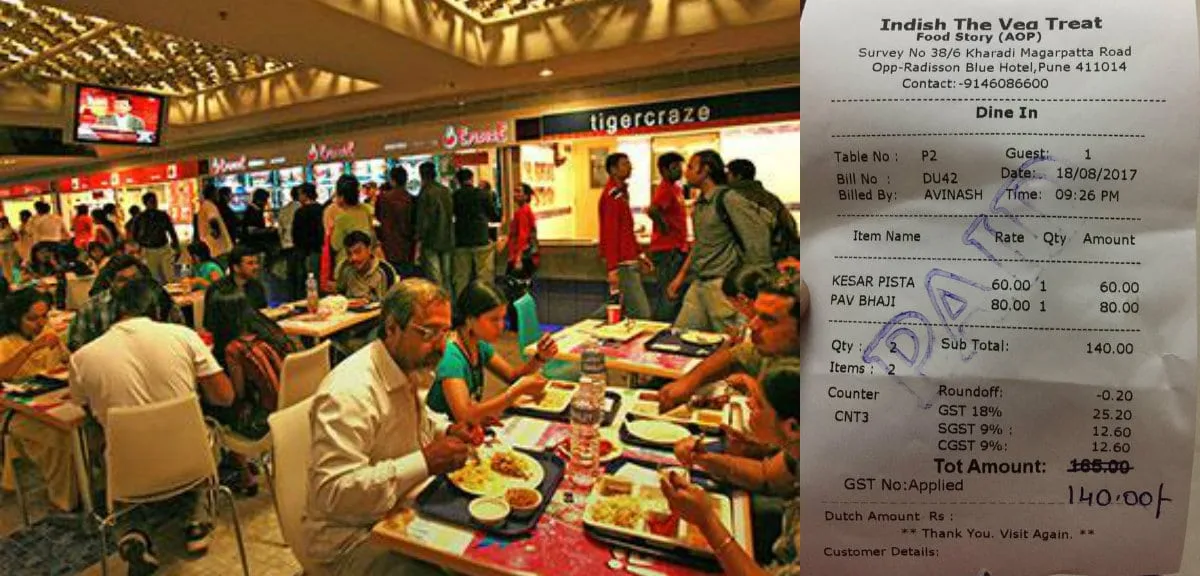

The sources have revealed that one such incident has been reported in the media after which the malpractice has come into the light. In one of the Facebook post published by one Mr. Jagadish Lade, he was fleeced by the restaurant in the name of GST. According to him, the Restaurant kept fleecing him continuously for 10 days and extra money in the name of GST, and when he brought this to the notice of restaurant owner, he agreed to repay the tax amount charged by them in an unauthorized manner.

Here in this story, Jagadish is a CA, and he is capable of sneaking the fraud easily but, what about the common man? Who will guide him? According to Jagadish, Here is a way you can also verify if you are not getting fleeced by the restaurants.

DISTINGUISHED BETWEEN REGISTERED AND UNREGISTERED RESTAURANTS

1. First thing is, check if the restaurant has printed the GST number on Invoice.

2. If not, then they are not eligible to charge the GST

3. In case if you feel the number is Fake, please check the following link to verify the same

https://services.gst.gov.in/services/searchtp

FIND OUT IF THE RESTAURANT IS ELIGIBLE TO CHARGE 18% GST

According to the reports, the GST that has been rolled out in the month of July, has a provision for two taxation slabs, 12%, and 18% respectively, and the above slabs are dependent on it, the restaurant is AC or non-AC, and whether the restaurant has the license to serve alcohol or not. The 12% and 18% GST rates include both CGST (Central GST) and SGST (State GST).

- In the 12% slab, 6% is CGST and the remaining 6% is SGST

- In the 18% slab, 9% is CGST and the remaining 9% is SGST

THE 12% GST RATE CRITERIA ARE

- Non AC Restaurants

- Roadside Eateries that does not serve an Alcohol

- Local delivery restaurants

THE 18% GST RATE CRITERIA ARE

- The Fully Air Conditioned Restaurants (with or without Alcohol)

- Non AC food outlets that serve Alcohol

According to the latest CNBC reports, the GST rate of 18% will be applicable for the Restaurants with Bar despite the fact that it is partially air-conditioned and serves the food and liquor only on the one portion of the restaurant.

WHERE TO REPORTS THE FRAUD

Now coming back to the bottom line, if despite all these if you still find the irregularities in the food outlets you can reach to the following authorities here below

Email: helpdesk@gst.gov.in

Phone: 0120-4888999, 011-23370115

Twitter: @askGST_Goi, @FinMinIndia

SOURCE: THE LOGICAL INDIAN | FACEBOOK | NEWS HUNT | HT