Who Doesn’t want to Get Rid of Their Debt? Every one of us sometimes or other has surely taken a loan or spent the money on Credit Cards to do the shopping. All of us have only one agenda in our life, how to get to rid of the debt and become tension free. If you are not one of them, then there is no point in proceeding with this article further but, if you really want to get rid of all your debts, then this article is for you…

Here I am going to give you all the practical solution for your problems of debt. I am not talking in the air but I am going to show you the way thereby you will get closer to your goals. You may not like what I am going to tell you here or you may also feel offended by the same but, it does not matter to me, cause what I am about to tell you here is going to benefit you. Hence, if you feel that you are ready to face the reality, please go ahead.

We are living in the world where all the responsibilities are on one person or we can say on the head of a family. We have to pay the monthly installments of many loans we have taken, which includes the EMIs of the Home Loan, Car Loan, Phone Loan, Credit Card payments & Personal loans. But, the problem here is, despite all our efforts, we cannot pay off all the debts, and due to this, our liabilities keep growing. If you really want to get rid of all your debts, then I have a magic formula for you. You will just have to remember and follow the four basic steps here religiously and I assure you that all your debts will be nullified soon.

Do not Take any new loans

Make the budget of your income and expenditures

Reduce your expenses

Finally Making a plan for finishing your loans

If you think that you can do these 4 things, then I assure you that all your loans will disappear soon. I am telling you these things out of my experience, cause there was a time when I had many loans on my name, and I was tired of paying the EMIs and at that juncture the above formula which I am going to share with you here.

Let me tell you one thing, by using the above formula today I don’t have any loans in my name except for the payment of my home loan and the day I feel that I want to close my home loan, I have enough investments to do that, that means today I do not have absolutely any loans. I am going to guide you step by step how to get rid of your liabilities, and the first step towards that is, do not take any more loans. If you trust my words, please continue reading further or else stop right here…

STEP 1. DO NOT TAKE ANY NEW LOANS

In fact, this is common sense, But we all know that common sense is not that common anymore. In most of the cases it happens that the moment we get more source of income or we finish our earlier EMIs, we decide to take a more loan, and sometimes we do the shopping with credit cards too, which charges the interest rate of 40% per annum. Hence, if you wish to finish your debts, please do not take any more loans.

whatever may be the reason but don’t take any loans. Don’t eat in the hotels, and do not do more online shopping. Make use of the old or broken phone for another six months but, do not take any new loans. Only if you are going to stick to the above plans you will be in the position to finish your debts, and if you are ready to do that then only go ahead with the second step, or else stop right here, cause it will be of no use to you. Next thing you need to do is make the proper budget of your income and expenditures.

STEP 2. MAKE THE BUDGET OF YOUR INCOME AND EXPENDITURES

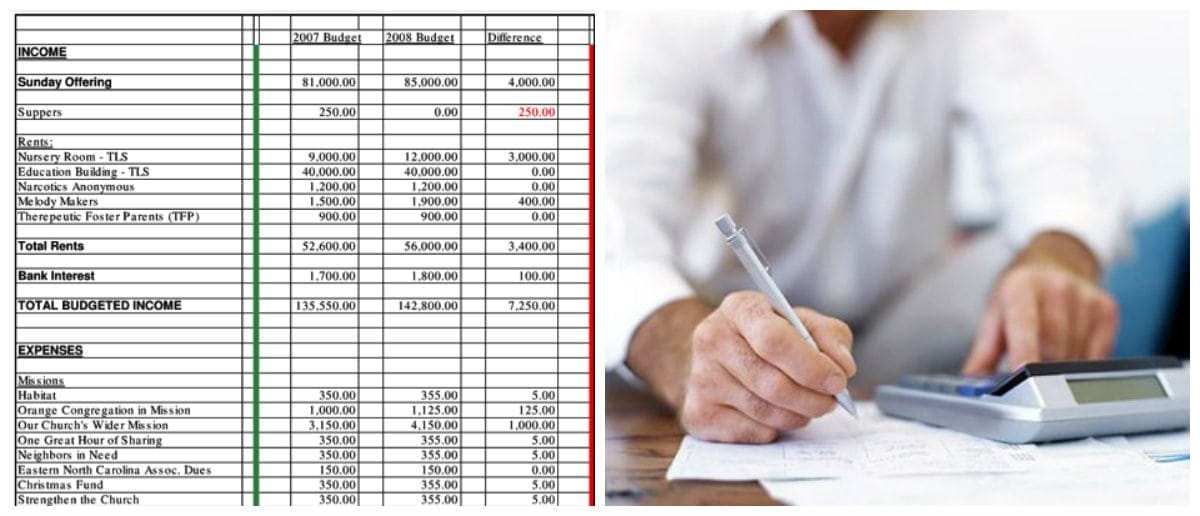

Make the budget in such a way that you do not miss a single dime that you spend. Write down the entire expenditure under different heads. Let me show you the same for the following example…

Suppose, you have multiple loans such as Home Loan, Car Loan, Instalment of Phone, School Fees, Bike Loan, Mobile Bills, Electricity Bills, Grocery, Milk bills, and such other hundreds of expenses. You will need to make the list of each and every expenditure. It does not matter if the expenditure is one rupees or one thousand, make sure that you get the record of each and everything.

You may find it tedious initially but, if you genuinely want to get rid of the debts, then you must find the way out to put things together. You do not have any alternative for this and you must do it. Once you made the list of your outgoing revenue source, next you need to start writing the amounts in front of it. For example, if the school fees is Rs. 1000 you need to write it down in front of the school fees and so on, and finally you are going to get the figure that you need at the end of the month. Once you get the expenditure figure, you need to minus your income from it and find out your actual savings. it depends on your expenditure, you will get the balance finger which can be positive or negative.

In case you get the negative figure, you need to reconsider your expenditure once again, and if you get the positive figure, then you need to keep aside 50% of it into your piggy bank and remaining 50% you can to spend towards your monthly expenditure. Once you reach up to here, the next step will teach you how to reduce your expenditure.

STEP 3. REDUCE YOUR EXPENDITURE

The best way to reduce your expenditure is to cut down on the small expenses, which normally we consider to be of less importance. You can start by cutting down on your mobile bill followed by saving on the electricity at home by switching off the appliances when not in use. Try the carpool instead of driving down to the office alone. This way you will save small amounts which will lead to a big saving in the due course of time.

I am not suggesting you become a stingy person but, this is the only way you can reduce your debts. Hence, if becoming little stingy can take you out from the pilling debts, please go ahead and do it right now. Make sure you that you do not incur the expenditure until unless it is necessary. Now with this, we reach our last goal, and that is, making a plan for finishing the loans.

STEP 4. MAKE A PLAN FOR FINISHING ALL YOUR LOANS

This is the most important step in this section and hence I suggest you to read it very carefully. Let do First thing first. Make a list of all your debts that includes various loans and outstanding. Write down the amounts in front of each head. Make the list of your debts in a descending manner. For example, your home loan is Rs. 10 Lacs, then it will come right on the top of the list and it will be followed by the car loan, credit card, phone loan and so on. You will wonder why I am telling you to do this. Let me explain it to you.

Once you know what is your debt, you need to reduce the burden of it starting with the smallest loan amount. The moment you get your next months salary, you will have to make use of the savings that you had done in your piggy bank last month clubbed with this months surplus money to pay back the smallest loan amount in the list by depositing the lump some about into the bank account. In case your bank does not have the facility to make the part payment, you can always deposit that money into the saving account till it reaches to loan amount you own to the bank and payback.

Now once you finish your smallest loan you don’t have the stop here, you need to keep depositing the loan installment money if your pre-closure into the piggy bank and create the bigger corpus to pay back the next loan amount in the list, and this way you will keep reducing your debts one by one. This way you will finish all your debts and live your life peacefully.

Let me tell you the task which I have told you just now, is not at ease, but if you want to get rid of your debts, then you must follow these footsteps. Here your income source will not make any effect, this formula will work. Of course, at the end of the day, it is your choice whether to follow this tried and tested formula or carry on with the debts. It is entirely your life, your choice, and your loan, which you will have to pay off one day.

In case you like this article please do let us know in your comments.

SOURCE: SUCCESS AND HAPPINESS