The deadline to fill out Income Tax Returns is nearing. What’s usually the deadline is June 30th of every year, but for the Annual Financial Year of 2020-2021, the deadline for filing ITR has been extended to November 30.

In light of recent events, the decision was taken to hopefully, grant some relief for the Chartered Accountants, assesses, and the public in general.

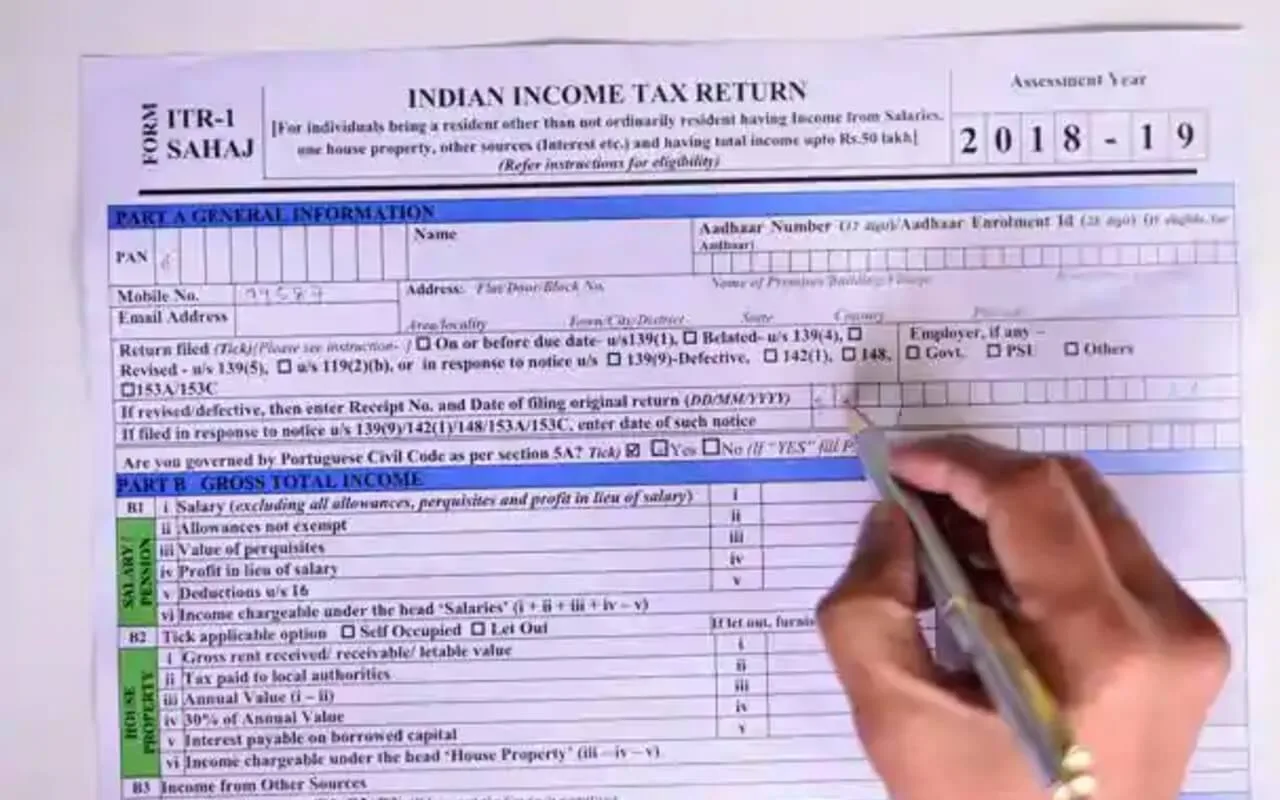

If you’re an individual, you are required to fill the ITR-1 Sahaj form, which is applicable to individuals with income of upto 50 lakhs.

If you are applicable to ITR-1 here is everything you need to know while filing for returns:

ITR-1 can be filled by any resident individual with an annual income of upto 50 lakhs. Total income here includes:

- Income from salary or pension

- Income from one house property

- Income from other sources such as interest from a bank account (excluding winning from lottery and income from racehorses, income taxable under section 115BBDA or Income of nature referred to in section 115BBE)

- Agricultural income up to Rs 5,000

- In cases where there is an income of another person like spouse, minor child, etc., it is to be clubbed with the income of the assessee. Note that ITR-1 Form can be used only if the income being clubbed falls into one of the income categories mentioned above.

- Documents required to file returns under ITR 1:

- General information: PAN number, Aadhaar number or enrollment ID in case you don’t remember your Aadhaar number

- Salary/pension: Form 16 from your employer, or multiple employers in case you have changed your job during the year

- Income from house property: Rent receipts, housing loan for deduction of interest etc.

- Income from other sources: Bank statement or passbook for computing interest earned on bank accounts, fixed deposits, time deposits, post office savings passbook, winnings from lottery details, details of clubbed income.

You can claim deductions with receipts of the following:

- Provident fund or NPS

- Your child’s school tuition fees paid during the financial year

- Life insurance premium

- Health insurance premiums

- Stamp duty and registration charges

- Principal repayment on Home loans

- Equity-linked savings scheme or Mutual Funds

- Donations eligible for 80G

In order to file for ITR, one needs to be registered with the Income Tax Department’s e-filing website. You will be required to enter your PAN details, mobile number, e-mail id, and your current address, all of which are mandatory.

To register you need to go to www.incometaxindia.gov.in

- Once on the site, click the register

- Select ‘Individual’ from the list of options. Click ‘Continue’

- Enter the required details and click ‘Submit’

- Fill in other details as required correctly. You will be required to enter a password here which you can use to login. Note that the details are correct as the Income Tax Department may send you emails and SMS.

- Click ‘Continue’

- Verify your account by entering the OTP and clicking on the link sent to you via email.

Once registered you can login using your PAN and password.

To file for ITR you need to go to incometaxindiaefiling.gov.in.

You can log in here using the details you set in the previous steps.

- Click on the filing of the income tax return option.

- You will be redirected to a new page from which you can select the assessment year and the form ITR-1 and the filing type- original or revised.

- Once done under the submission mode, click on ‘Prepare and Submit online.’

- Select your pre-validated bank account to avail of any IT refund that may be applicable to you.