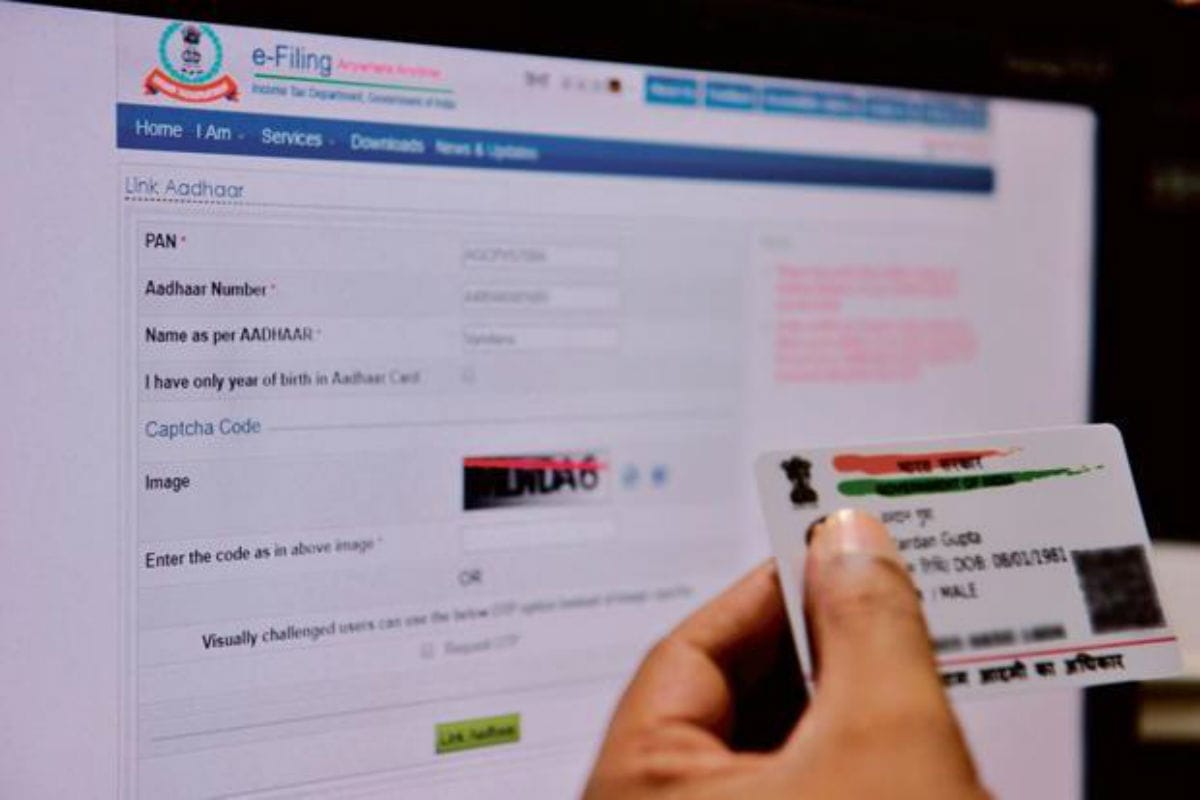

There seems to be no end to linking one document to another and every time things get more difficult since the digital evolution does not go well with the submitting hard copies for the purpose of verification. This is the fourth time the Government has extended the decline for linking the PAN card with Aadhaar. What is the new deadline and what you need to know before you link you try linking you PAN with the Aadhaar, let’s take a look in this article?

The new dates of linking your PAN with Aadhaar have been extended till 31st March 2020 making the task more easier for the people, or perhaps really easier? here we have compiled five things that you need to know before you attempt linking of your PAN Card to Aadhaar one more time, or perhaps the last time!

According to the notification from the Income Tax Department, Now the Aadhaar card can be used in lieu of PAN card by both those who have PAN card and also those who do not have it. According to the report published in the Live Mint, The income tax department has once again extended the deadline for linking of PAN card and Aadhaar card.

After the 2018 Supreme Court verdict on constitutional the validity of Aadhaar, the 12-digit identification number is mandatory not only for filing of income tax returns (ITR) but also for Permanent Account Number (PAN) card.

Here are the five things that you must remember when you link your PAN card with the Aadhaar this time.

1. For New Applicant PAN is Automatically Linked to the Aadhaar

In case you are applying for a new PAN Card then you need to fill your Aadhaar card details in your application form and after that, you are allowed to use your Aadhaar number wherever PAN is sought. PAN and Aadhaar numbers are now interchangeable. For new applicants of PAN card, the interlinking is done automatically during the application stage.

2. Existing PAN Card Holder Linking Aadhaar is Mandatory

The above privileged is not available for the existing PAN card holder and thus they have to connect the PAN to Aadhaar on or before the last date that is 31st March 2020. The linking process can be done on the income tax department’s e-filing portal or even simply by sending an SMS. You can also check the status of your linking online.

3. As a Taxpayer, it is Mandatory to Link Your PAN with the Aadhaar

As per the guidelines from the Income Tax department, every Tax Payer must like their PAN card with to the Aadhaar card since in absence of that you will not be able to file the Income Tax returns and also lose your PAN number. As many taxpayers are yet to interlink their Aadhaar with PAN, the deadline has now been extended for the eighth time by the income tax department. The last date of 31 December 2019 has now been extended to 31 March 2020.

4. People Fear that all their Private Documents will get exposed after the Linking

There is a common fear amongst the people that all their private documents will get exposed once they link their PAN with the Aadhaar. A tax professional said that even many business people are yet to link the two documents as they have certain apprehensions. “Aadhaar number is being used virtually for getting almost all the documents such as passport and voter identity card. Besides, it is required for the purchase of properties and vehicles. Many people fear that once they link their Aadhaar with PAN, all their information would be automatically shared with the government,” the tax consultant said.

5. No Linking No Filing IT Returns

If for whatsoever reasons you are unable to link your PAN card to your Aadhaar within the stipulated time, i.e. 31st March 2020, the income tax department will start treating all unlinked PAN cards as “inoperative” ones. This means that your PAN card will not be treated as being in use and you will also not be able to file income tax returns (ITR).

Source: Live Mint